How Do Mexicans Send Remittances from the United States?

99% of remittances are sent through electronic transfers via specialized establishments, banks, and digital platforms.

We know the importance of remittances for the country, but little is said about how Mexicans send part of the resources generated in the United States to their families in Mexico.

Publicidad

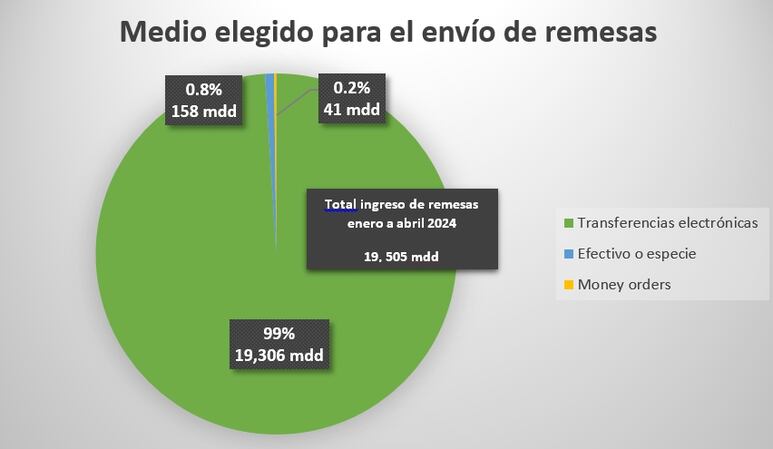

According to the Bank of Mexico, the most used method for sending remittances in the first quarter of 2024 was electronic transfers, accounting for 99% of transactions with a total of $19.306 billion.

Cash and in-kind remittances represented 0.8% with $158 million, and money orders accounted for 0.2% of the total amount, reaching $41 million out of the $19.505 billion that entered the country from January to April 2024.

This predominance of electronic transfers over other remittance modalities is not a recent phenomenon. Since 2008, there has been a sustained increase in transactions made through this method, surpassing 90% of the total.

Publicidad

What are electronic transfers in remittance sending?

Publicidad

To make an electronic transfer, a financial institution (bank) or remittance company is required to transfer funds from one country to another.

According to the National Commission for the Protection and Defense of Financial Services Users of Mexico (Condusef), there are three types of electronic transfers: without a bank account, with a bank account, and digital.

Transfers without a bank account are carried out by companies and banks in the United States with agents in Mexico to make payments at bank branches, currency exchange houses, pharmacies, gas stations, commercial chains, among others.

Among the most used companies for sending money from the United States to Mexico and other Latin American countries are Western Union, with around 31% preference, followed by Ria Money Transfer with 23%, and then companies like Moneygram and La Nacional with 10%, according to data from the Statista portal, obtained from a survey conducted with 2,145 people (2019) in the cities of Los Angeles, Miami, and New York.

On the other hand, digital transfers use a website or digital app to send remittances, charged to a credit card, debit card, or bank account.

The most used platforms in this area are Xoom with a preference of 63%, followed by Western Union with 14%. Ria Money Transfer holds the third position with 5%, and Moneygram ranks fourth with 4%, according to information from Statista.

Finally, transfers through bank accounts require that the sender has this service in their place of residence, and the beneficiary in Mexico can withdraw it from an ATM or teller window, primarily. In this area, remittances are mainly sent through companies like Citibank, Wells Fargo, and Bank of America.

According to the 2019 Northern Border Migration Survey (EMIF Norte), we know that sending remittances through commercial establishments is predominant over banks, as 83.0% of Mexican migrants interviewed sent their remittances through convenience stores, pharmacies, supermarkets, grocery stores, or specialized establishments, while only 10.4% did so through a bank.

The preference for commercial services could be explained by the wide availability of money transfer establishments in the United States over bank branches, the lack of banking infrastructure in recipient communities, as well as the ease provided to recipients for collecting the money.

How are remittances sent by electronic transfers collected in Mexico?

The choice of remittance collection method is subject to different factors, such as having a bank account, the proximity of branches or establishments, and even having adequate transportation means.

In this sense, electronic transfers offer collection possibilities according to the needs of remittance recipients, whether through deposits into bank accounts or cash payments at financial institutions, banks, or other types of commercial establishments, such as stores, pharmacies, supermarkets.

According to the Bank of Mexico, in 2019, 25% of remittances arrived at banking institutions (account deposits, cash withdrawals at teller windows or ATMs), while the remaining 75% were collected at non-banking institutions.

Mexico still faces significant challenges in financial inclusion, which could explain why remittance collection at commercial establishments prevails. Remittances are also a driving force in reducing inequalities in this area, both for senders and recipients.

Financiera para el Bienestar and remittance sending

Financiera para el Bienestar plays an important role in sending remittances through the traditional method, as it has a network of more than 200,000 affiliated remittance agencies in the United States that facilitate money transfers and cash collection at any of the 1,700 Finabien branches in Mexico. In 2023, $2 billion was sent through this method.

Additionally, it allows digital remittance sending through its mobile application available for download in the United States and Mexico. As of January 2024, more than 60,000 cards have been issued in the United States and 170,000 in Mexico, facilitating the transfer of just over $6 million since its launch.

Publicidad

Publicidad

Más Leídas | Heraldo USA

Robert Prevost, el nuevo papa León XIV: por qué eligió ese nombre y su significado

Por Heraldo USA

“Será un cónclave rápido”: Mhoni Vidente revela quién será el nuevo Papa

Por Heraldo USA

Cónclave 2025: ¿Quién es Robert Prevost, el nuevo Papa de la Iglesia Católica elegido hoy jueves 8 de mayo?

Por Heraldo USA

¿Qué significa la frase “habemus papam” y cuál es su origen?

Por Heraldo USA

Publicidad

Más noticias de Remittances

Más noticias de Actualidad