Remittances fall

Thus, in March 2024, with an average exchange rate of 16.84 pesos per dollar, Mexico received approximately 84.6 billion pesos in remittances

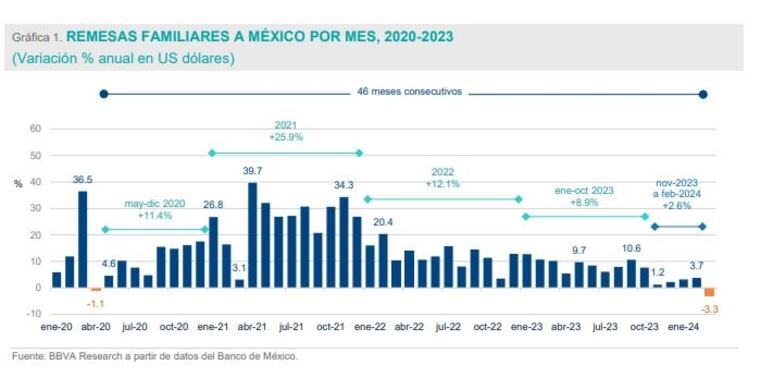

According to information from the Bank of Mexico, during the month of March of this year, $5.021 billion dollars entered our country in the form of family remittances, representing a 3.3% in remittances received compared to the same month of the previous year.

Publicidad

This marks the end of a streak of 46 consecutive months of growth, which lasted from May 2020 to February 2024. During this nearly 4-year period, remittances increased from $38.8 billion to $63.6 billion in annualized terms, equivalent to a total growth of 64.1% over those 46 months.

Considering that in March the exchange rate was less than 17 pesos per dollar, in addition to the inflation factor, remittances contracted by 15.2% in real terms compared to a year ago, a significant drop in income for the families receiving these resources, as explained in the report by the BBVA Research Department.

The final effect on the pockets of remittance-receiving families in the country is even greater. In addition to the decrease in dollars recorded in remittances and the inflation factor (4.4%), it should be considered that March was one of the months in which the price of the US dollar fell below 17 pesos, resulting in fewer pesos at the time of receipt. Thus, in March 2024, with an average exchange rate of 16.84 pesos per dollar, Mexico received approximately 84.6 billion pesos in remittances.

Publicidad

Remittances to other countries in Latin America and the Caribbean also had a lower performance in March compared to January and February. Remittances to El Salvador fell by 4.9% and to Honduras decreased by 4.6% during the month of March.

Publicidad

BBVA Research points out that there may be two possible explanations for this phenomenon. The first may be due to a calendar or seasonal factor, as the Thursday and Friday of Easter Week 2024 fell in the last working week of March. This may have caused some people not to send money to their relatives during that week, due to difficulties in collecting it in their home countries.

This would suggest that there were no structural impacts on the flow of remittances to the region, but simply that some remittances would be transferred to be collected and accounted for in the first days of April.

A second hypothesis about the recent deceleration of remittances to the region could be explained by a structural issue, in which the economy of the United States (the main destination country for migration from most countries in the region) may be reaching a level at which it is less easy to absorb migrant labor. This is due to the significant flow of migration and refugees that the country has received since late 2020 until now.

On average, in 2023 and the first part of 2024, there have been more than 200,000 apprehensions and inadmissions of migrants monthly at the southern border of the United States. Additionally, the industrial sector in Mexico, dominated by manufacturing, has seen two quarters of contractions, the fourth quarter of 2023 and the first quarter of 2024, partly explained by a lower demand for durable goods in the United States.

Thus, it is necessary to monitor the data that emerges in these months to understand if the recent deceleration of remittances to Mexico and several countries in Latin America and the Caribbean is explained by a seasonal factor or if we are facing signs of a possible economic slowdown in the United States.

Publicidad

Publicidad

Más Leídas | Heraldo USA

EN VIVO: Sigue minuto a minuto la conferencia matutina de Claudia Sheinbaum HOY 3 de julio

Por Heraldo USA

La polémica historia de amor de Chantal Andere y Roberto Gómez, hijo de ‘Chespirito’

Por Heraldo USA

Precio del dólar HOY en México: jueves 3 de julio 2025

Por Heraldo USA

Jaime Vázquez Bracho: La Cuarta Transformación llegó a todos los consulados de México

Por Heraldo USA

Publicidad

Más noticias de Remittances

Más noticias de México